Whether you are a business executive looking to invest in new equipment or a vendor seeking financing options for your clients, you can leverage flexible financing through First American to achieve your goals.

-

-

Leasing & Financing Overview

Leasing & Financing Overview Leasing & Financing Overview

-

Equipment Financing Equipment Financing

Discover how we can help streamline your capital projects through our equipment financing solutions.

-

Vendor Financing Vendor Financing

Integrated vendor financing programs—designed to simplify your customers' purchasing experience. Explore how our vendor programs can help you sell more, faster.

-

Commercial Cards

Commercial Cards Commercial Cards

Transform the way you manage expenses and close your books faster with the City National Visa Commercial Card program presented by First American.

-

Leasing & Financing Overview

-

Industries Industry Specialization

Gain valuable insights by working with finance experts aligned to your industry.

-

Case Studies

Panel Content -

Thought Leadership

Thought Leadership -

About About Us

Tap into the strength and expertise of one of the largest equipment finance companies in the U.S.

-

News

News Stories -

Contact Us

Contact Us Contact Us

Connect with a financing expert to discuss your organization's needs today.

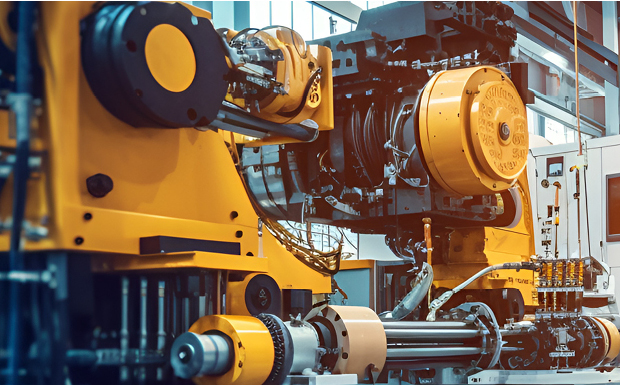

Manufacturing | Vendor Financing Program

Shifting Customers’ Focus from Price to Value

Feeling the Pressure: Discount Prices or Risk Losing the Sale?

Due to the competitive nature of the industry, supply chain solution manufacturers frequently face pressure to either lower their prices or risk losing the sale. When an established vendor on the West coast faced this challenge, salespeople approached their CFO requesting they begin offering financing to their customers. Although they were conversing with value-driven buyers, consistently lower prices from competitors were causing them to consider making price-driven decisions. The sales team needed a strategy to fight their low-cost rivals.

To gain a competitive edge, the sales team sought a new strategy to add value without lowering prices.

Providing a financing option helped shift the focus from price to value.

To help conversations stay focused on value, First American developed a “win-win” solution in the form of a private label finance program.

The Customer Win: Convenience

The ability to finance projects directly through the manufacturer at no extra cost delivered both convenience and value. Customers could select their desired terms, customize payment plans to align with their budget goals, and eliminate the time-consuming process of coordinating with a bank.

The Vendor Win: Focus on Value

By presenting a proposal with a customized payment plan, the salesperson eliminated the initial apples-to-apples comparison (the full price of their solution versus the full price of a competitor’s solution) that was causing hesitation for customers. Instead, they were able to focus customers’ attention on the value they were receiving rather than the price disparity.

In the customer’s eyes, the vendor’s financing program made them a full-service provider—they manufactured the solution, distributed it, and could also finance it. When the sales team offered payment options, there was no confusion. They were talking about their own financial services division and bypassed the need to talk about First American’s credentials. Behind the scenes, First American was running the program, but to customers it appeared as a single, seamless process managed entirely by the manufacturer.

The results: differentiating instead of discounting.

With custom payment structures available for each customer’s individual budget needs, the sales team felt well-equipped to tackle price hesitations. Since the vendor program was established with First American in 2016, pressures to discount pricing have decreased, while sales have increased.

Payment flexibility made selling easier for the sales team and made saying “yes” easier for their customers.

Feeling the Pressure: Discount Prices or Risk Losing the Sale?

Due to the competitive nature of the industry, supply chain solution manufacturers frequently face pressure to either lower their prices or risk losing the sale. When an established vendor on the West coast faced this challenge, salespeople approached their CFO requesting they begin offering financing to their customers. Although they were conversing with value-driven buyers, consistently lower prices from competitors were causing them to consider making price-driven decisions. The sales team needed a strategy to fight their low-cost rivals.

“We never thought of our customers as needing financing, but then we realized what it does.”

– CFO, West Coast Supply Chain Solution Manufacturer

To help conversations stay focused on value, First American developed a “win-win” solution in the form of a private label finance program.

The Customer’s Win: Convenience

The ability to finance projects directly through the manufacturer at no extra cost delivered both convenience and value. Customers could pay on their own terms, customize payment plans to align with their budget goals, and eliminate the time-consuming process of coordinating with a bank.

The Vendor’s Win: Focus on Value

By presenting a proposal with a customized payment plan, the salesperson eliminated the initial apples-to-apples comparison (the full price of their solution versus the full price of a competitor’s solution) that was causing hesitation for customers. Instead, they were able to focus customers’ attention on the value they were receiving rather than the price disparity.

In the customer’s eyes, the vendor’s financing program made them a full-service provider—they manufactured the solution, distributed it, and could also finance it. When the sales team offered payment options, there was no confusion. They were talking about their own financial services division and bypassed the need to talk about First American’s credentials. Behind the scenes, First American was running the program, but to customers it appeared as a single, seamless process managed entirely by the manufacturer.

“By providing a financing option it also takes a lot of the focus off of price and it puts it on value.”

-– VP, Sales, West Coast Supply Chain Solution Manufacturer

The results: differentiating instead of discounting.

With custom payment structures available for each customer’s individual budget needs, the sales team felt well-equipped to tackle price hesitations. Since the vendor program was established with First American in 2016, pressures to discount pricing have decreased, while sales have increased.

Payment flexibility made selling easier for the sales team and made saying “yes” easier for their customers.

The results

Differentiating Instead of Discounting

The results

A Healthy Relationship: First American and YMCA Build Long-Term Financing Strategy for Fitness Upgrades

5+

year relationship working with First American

With custom payment structures available for each customer’s individual budget needs, the sales team felt well-equipped to tackle price hesitations. Since the vendor program was established with First American in 2016, pressures to discount pricing have decreased, while sales have increased.

56%

average annual growth rate of deals financed through their integrated financing program over the first five years

Payment flexibility made selling easier for the sales team and made saying “yes” easier for their customers. This sales tactic is becoming increasingly popular, with project financing growing an average of 56% annually.

Make Saying "Yes" Easier

Contact us to get started with a vendor financing program today.

Harness the power of payment flexibility and simplify the purchasing experience for your customers with a vendor financing program from First American.