Whether you are a business executive looking to invest in new equipment or a vendor seeking financing options for your clients, you can leverage flexible financing through First American to achieve your goals.

First American recently hosted an economic forecast webinar with Gerard Cassidy, Managing Director at RBC Capital Markets. Using expert analysis from this presentation along with insights from industry thought leaders, we have put together key takeaways on the state of the U.S. economy, its complex web of cross currents, and implications for the future.

Resilience and Growth in the U.S. Economy

Despite significant economic advancements in other countries, such as China, the U.S. remains the key engine driving global economic activity. The resilience of the U.S. economy is evident as we move into the second half of 2024, with a continued focus on growth. The Federal Reserve projects a GDP growth rate of 2.0% for 2024, highlighting ongoing economic stability.1 This resilience underscores the importance of the U.S. economy to global investors and highlights opportunities for businesses, particularly in terms of capital investments and expansion strategies.

Consumer and Small Business Confidence

Consumer spending, which accounts for about two-thirds of the U.S. economy, remains a pivotal component of economic health. While consumer confidence and small business optimism have recently declined due to uncertainties around Federal Reserve policies, inflation, and geopolitical risks, they experienced sharp recoveries post-pandemic. Small businesses, as major drivers of new job growth, play a critical role in sustaining economic stability. The National Federation of Independent Business (NFIB) reported that the Small Business Optimism Index reached the highest reading since February 2022 in July of this year, at 93.7.2

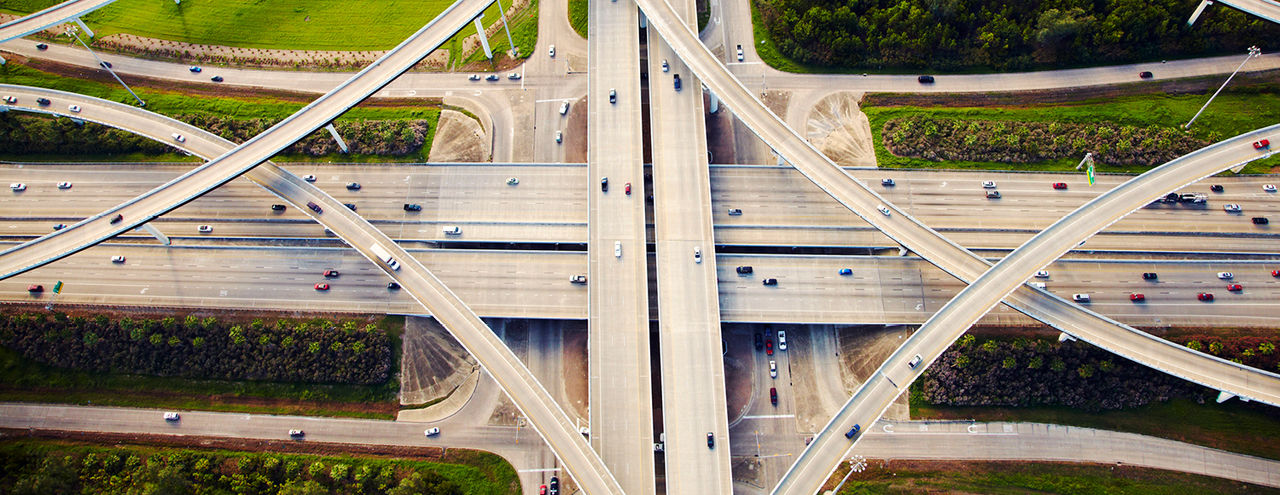

Migration Patterns and State Tax Climates

Migration patterns within the United States are significantly influenced by state tax climates and job growth opportunities. States like Florida, Nevada, Utah, and New Hampshire are attracting more residents due to their favorable tax conditions and robust job markets. Conversely, states with higher taxes, such as New York, California, and Minnesota, are experiencing out-migration. These trends impact regional economic growth and housing markets as more people move to states with lower taxes and better job prospects.

Housing Market Dynamics

The housing market continues to face challenges with inventory and affordability. High interest rates have led to a decline in both new and existing home sales. However, the shortage of housing inventory, coupled with high refinancing rates from previous years, creates a unique financial environment. According to the National Association of Realtors, there has been a significant impact on the housing market due to these factors, yet demand from demographics like millennials provides a favorable backdrop.

Corporate Financial Health

Corporate balance sheets remain strong, with companies maintaining high liquidity levels and manageable debt. This financial health is a positive indicator for economic stability and growth, suggesting that companies are well-positioned to navigate potential economic challenges. For equipment financing, the strong financial health of corporations translates to increased confidence in making significant capital investments, including new equipment and technology.

Interest Rates and Inflation Outlook

The Federal Reserve's interest rate policies are crucial for economic stability. Although the inverted yield curve typically signals an impending recession, this has not materialized yet, defying historical patterns. The Fed's potential rate cuts in late 2024 or early 2025 are anticipated to stimulate economic growth. However, there is a risk that lowering rates too quickly could lead to a resurgence of inflation, necessitating a reversal of policy, which could destabilize the economy. The Federal Reserve projects that the labor market overall is normalizing, with the unemployment rate at 4.1% in July 2024.3

The current outlook for the US economy is characterized by resilience and growth, despite the presence of various challenges such as inflation, housing market fluctuations, and geopolitical risks. By closely monitoring these factors, organizations can better navigate the complex economic landscape and leverage opportunities for growth and expansion.

Sources:

- Gerard Cassidy, 2024 Economic Forecast Webinar with First American, July 2024

- National Federation of Independent Business, Small Business Optimism Index, July 2024

- Federal Reserve, Chair Powell’s FOMC Press Conference, July 31, 2024

This article is for informational purposes only and is not intended to constitute legal, financial, or other professional advice. The accuracy of the information is not guaranteed and should not be regarded as a complete analysis of the topics discussed. No endorsement of any third parties or their advice, opinions, information, products, or services is implied by First American Equipment Finance or its affiliates.