Whether you are a business executive looking to invest in new equipment or a vendor seeking financing options for your clients, you can leverage flexible financing through First American to achieve your goals.

-

-

Leasing & Financing Overview

Leasing & Financing Overview Leasing & Financing Overview

-

Equipment Financing Equipment Financing

Discover how we can help streamline your capital projects through our equipment financing solutions.

-

Vendor Financing Vendor Financing

Integrated vendor financing programs—designed to simplify your customers' purchasing experience. Explore how our vendor programs can help you sell more, faster.

-

Leasing & Financing Overview

-

Industries Industry Specialization

Gain valuable insights by working with finance experts aligned to your industry.

-

Case Studies

Panel Content -

Thought Leadership

Thought Leadership -

About About Us

Tap into the strength and expertise of one of the largest equipment finance companies in the U.S.

-

News

News Stories -

Contact Us

Contact Us Contact Us

Connect with a financing expert to discuss your organization's needs today.

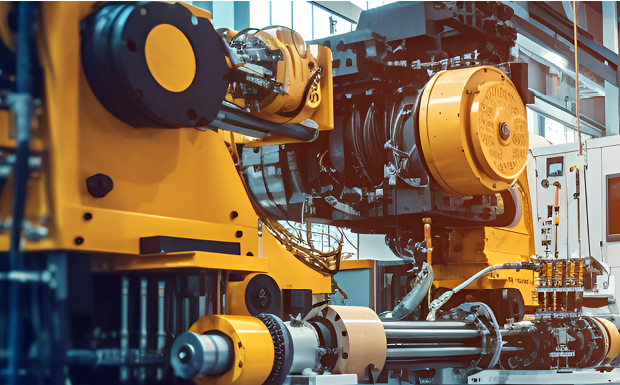

Manufacturing | Vendor Financing Program

Reducing Price Apprehension for Technology Projects

ENP Seeks New Approach to Overcome Customer Hesitations

As a premier industrial manufacturer, Emerson Network Power (ENP) was frequently approached by data centers looking to implement critical infrastructure projects. Equipment issues are the source of the most significant data center outages, and with most outages resulting in more than $100,000 in losses—and 15 percent resulting in upwards of $1,000,000 in losses—reliable technology was a priority for ENP’s customers.* Even so, when presented with the cost of completing these essential projects, their customers were hesitant to move forward. It was painful for them to think about how much they were going to have to spend. Which projects would they forgo in order to proceed?

*Uptime Institute, 2022 Outage Analysis Report

“A lot of times there was hesitation and almost pain in the customer’s face when they thought about what they were going to have to spend to get a job done.”

– VP, Sales Operations, ENP

“I think what First American did a great job with was coming in and understanding what it is we’re trying to solve for our customers and then figuring out what resources and capabilities they had so they could put something together that fit with our customers and with our sales organization.”

– VP, Global Solutions, ENP

Providing Financing Options Proves Key to Successful Customer Interactions

Initial conversations between ENP and First American focused on understanding the pain points that ENP and their customers faced. The goal was to make ENP’s pricing more palatable for customers, which in turn would make the sale easier for their sales team. To achieve this, First American developed a leasing program that gave customers the flexibility to choose whether their payment plan would be structured as an operating or capital expense. Operating leases are not commonly offered by traditional banks, so this was an attractive new option for customers with excess cash in their monthly operating budgets.

With an experienced finance Program Manager from First American by their side every step of the way, ENP’s sales team felt confident sharing leasing and financing information with their customers. Whenever a customer wanted to learn more about their payment options, ENP simply brought their First American Program Manager into the conversation to structure a payment plan that aligned with the customer’s budgetary requirements.

ENP Seeks New Approach to Overcome Customer Hesitations

As a premier industrial manufacturer, Emerson Network Power (ENP) was frequently approached by data centers looking to implement critical infrastructure projects. Equipment issues are the source of the most significant data center outages, and with most outages resulting in more than $100,000 in losses—and 15 percent resulting in upwards of $1,000,000 in losses—reliable technology was a priority for ENP’s customers.* Even so, when presented with the cost of completing these essential projects, their customers were hesitant to move forward. It was painful for them to think about how much they were going to have to spend. Which projects would they forgo in order to proceed?

*Uptime Institute, 2022 Outage Analysis Report

“A lot of times there was hesitation and almost pain in the customer's face when they thought about what they were going to have to spend to get a job done.”

– VP, Sales Operations, ENP

Providing Financing Options Proves Key to Successful Customer Interactions

Initial conversations between ENP and First American focused on understanding the pain points that ENP and their customers faced. The goal was to make ENP’s pricing more palatable for customers, which in turn would make the sale easier for their sales team. To achieve this, First American developed a leasing program that gave customers the flexibility to choose whether their payment plan would be structured as an operating or capital expense. Operating leases are not commonly offered by traditional banks, so this was an attractive new option for customers with excess cash in their monthly operating budgets.

With an experienced finance Program Manager from First American by their side every step of the way, ENP’s sales team felt confident sharing leasing and financing information with their customers. Whenever a customer wanted to learn more about their payment options, ENP simply brought their First American Program Manager into the conversation to structure a payment plan that aligned with the customer’s budgetary requirements.

“I think what First American did a great job with was coming and understanding what it is we're trying to solve for our customers and then figuring out what resources and capabilities they had so they could put something together that fit with our customers and with our sales organization.”

-– VP, Global Solutions, ENP

ENP Experiences Meaningful Pipeline Growth

With First American on board, ENP reps were able to shift their customers’ focus from the total price of the project to the overall value of the solution. Offering to spread payments over multiple years and pull from either their operating or capital budget made a powerful difference in the conversations they were having. Customers could now confidently move forward with their critical infrastructure projects without sacrificing other valuable initiatives. As a result, ENP saw a decrease in the length of their sales process and their pipeline was experiencing meaningful growth.

“We’re seeing our pipeline grow with First American leasing opportunities and it’s been very exciting to be a part of this journey.”

– VP, Sales Operations, ENP

Make Saying "Yes" Easier

Contact us to get started with a vendor financing program today.

Harness the power of payment flexibility and simplify the purchasing experience for your customers with a vendor financing program from First American.